SMSF Property Investment

The Redwood Property Investment Advantage

Known | Experienced | Trusted

What We Offer

At Redwood we are passionate about creating wealth through SMSF property investment. Our experienced property strategists will develop a plan to build wealth by investing in property just for you.

Why choose Redwood when investing in Property?

SMSF consultation and roadmap to ensure an SMSF is right for you

We are SMSF Property Specialists

Same day SMSF and Custody Bare Trust set-up including Corporate Trustee

We will assist you with SMSF bank account and rollover so you can pay your deposit quicker

Value for money – fixed fees with legal Trust and Custody deeds to be accepted by all lenders – no online providers are used

Consultation

Contact us for a free no obligation consultation

How Does ‘self managed super funds buying property’ work?

Redwood Advisory – SMSF Property Specialists make borrowing to invest easy contact us today for a consultation (fees will apply).

How does ‘borrowing to invest’ work?

Seek advice

Review your SMSF trust documentation

Set up a separate security trust

Funding your investment

The security trust buys and holds the property

Key Benefits of SMSF Property

SMSF Property Investing is not for everyone. However, with the right guidance and education, SMSF Property investing either through a third-party lender or a related party can be a great way to diversify investments and create wealth for your retirement. Remember thats why over 1 million Australian’s use SMSFs to invest their superannuation for their retirement.

Key benefits are:

Secure your financial freedom by investing in property

Deposit paid out of your superannuation balance not your personal savings

Huge tax benefits including no tax on gains/ income in retirement

Ongoing costs (i.e. SMSF administration) are paid out of your super balance and tax deductible

Lender has “Limited Recourse”, ensuring your SMSF assets are protected

Pay all setup costs out of your super balance, without cutting into your household budget

At Redwood, you will meet with our experienced staff to ensure you receive the education required to understand the benefits and risks of investing in property.

How Does SMSF Borrowing Work?

Seek advice

The rules and regulations for setting up and borrowing through a SMSF are complex. Redwood Advisory’s SMSF specialists can make borrowing to invest easy to understand to make sure this investment strategy is right for you.

Review SMSF trust documentation

If you already have a SMSF or a new SMSF, you’ll need a SMSF Specialist Advisor to review your Trust Deed to ensure you have the necessary powers to borrow under your fund. It is important you seek appropriate advice. By doing this upfront, it will avoid the nasty surprise when the Bank’s lawyers send a bills upon settlement of the property.

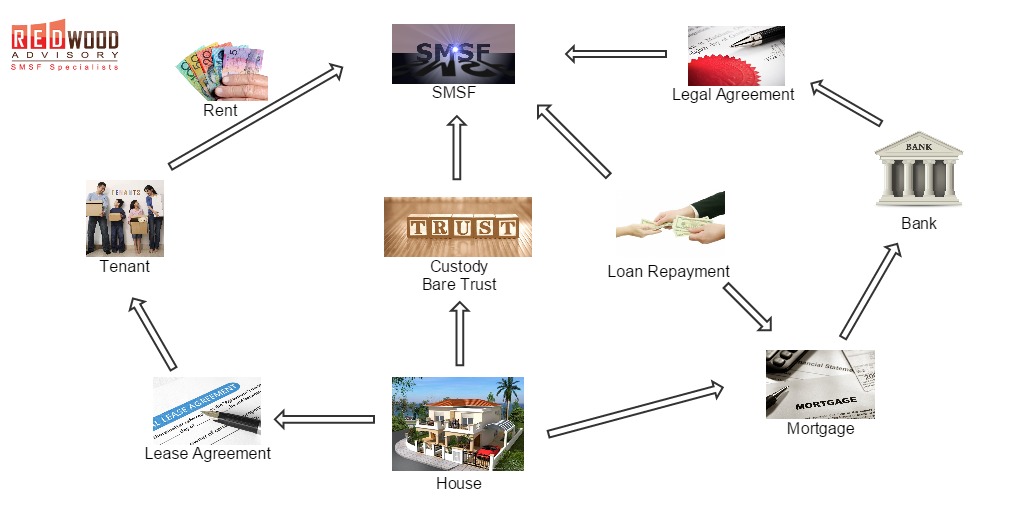

Set up a separate security trust or Bare Trust

The first step to purchasing an SMSF investment property through your SMSF borrowing is by setting up a separate security trust (commonly known as ‘Bare Trust’) on behalf of your SMSF. This new security trust will buy and hold the property, and provide a guarantee for your SMSF loan.

Loans to SMSF’s are “limited recourse loans”. This means that if you default the bank can only access:

the investment property

any other property securing the loan

The bank won’t be able to access your other SMSF assets.

Note – most if not all SMSF lenders will require a personal guarantee when obtaining a SMSF Loan.

Funding your SMSF property

A common error made by SMSF Trustees is paying for the deposit on the SMSF Property from personal funds.

The deposit for the SMSF Property must be paid from your SMSF balance, and a SMSF Property loan is obtained to cover the difference. Superannuation contributions can be used to service the loan as well as salary sacrificed contributions.

There are a number of lenders providing competitive rates on SMSF Property loans, generally offering 80% LVR for residential property and 70% for commercial property. Recently, investment lending overall including SMSF Loans have been subject to scrutiny and change, be sure to consult Redwood for a loan assessment prior to proceeding with your SMSF Property purchase.

By completing Redwood SMSF Loan Assessment, you will have the piece of mind to know how much you can borrow and the likely interest rate and product terms.