There are a number of strategies available to SMSFs to benefit your retirement and importantly save tax. An important strategy we need to consider is salary sacrifice.

Saving for a better tomorrow is the mentality of running a Super Fund. That is, we all want to live carefree and as prosperous as we can when we reach the age of retirement. But how do we get there? Is our current super guarantee (currently 9.5%) really enough? Are we saving effectively for a better tomorrow?

A tool that can help us achieve this goal is Salary Sacrificing.

Salary sacrificing is a tax effective saving strategy, where by an agreement is struck between you and your employer to “sacrifice” and contribute a portion of your current take home salary into your super fund. Who wins from this agreement? You do!!! This agreement not only help us grow our super balance by allowing us to contribute more to our super fund balance but the power of this strategy comes from the Tax Savings you make whilst doing so. That is, any portion of your Salary Sacrifice contribution made to a complying super fund, will NOT counted as part of your Personal Assessable Income. This will mean a huge tax saving for those with a Personal Marginal Tax Rate above 15%.

By making a Salary Sacrifice Contribution, you have made a Concessional Contribution into you Super Fund. When we make a Concessional Contribution, this will be Concessionally Taxed in your Super Fund at the rate of 15%. If however, we choose not to adopt this strategy, any portion of our pay not Sacrificed would be subject to our marginal Tax Rate which may well be: 32.5%, 37% or even 45%.

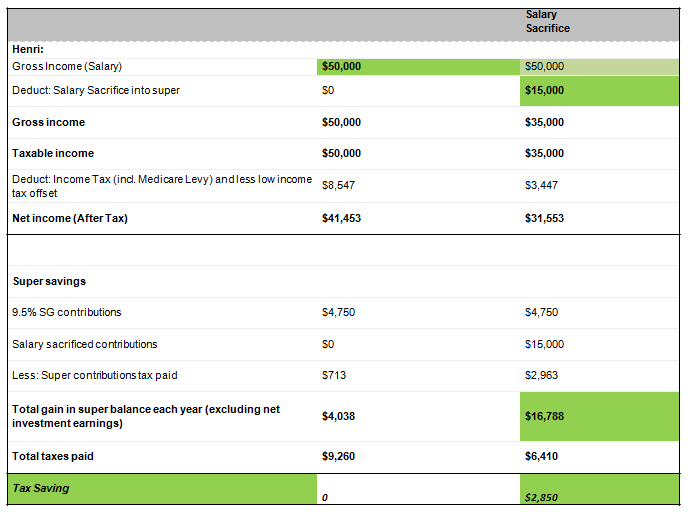

Let us put this to the test:

Henri has a current take home pay of $100,000.00 including Super (9.5%). She wants to know how much tax she will save if she was to adopt a Salary Sacrificing agreement with her employer.

Given this comparison, we see Henri has made a generous contribution to a “better tomorrow” and has saved a substantial amount of tax paid at year end.

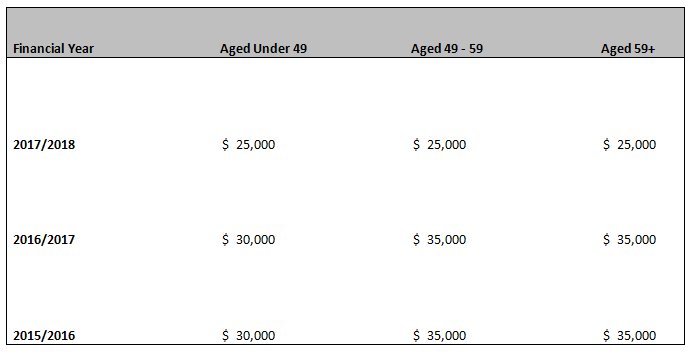

Now, before we start jumping in head first with this exciting and tax beneficial strategy, there are limits to how much we can Concessionally Contribute to our Super Funds. That is, the Tax Man is not going to let all of us Salary Sacrifice our whole take home pay and a pay this low tax rate of 15%. These limits have changed over the years and are outlined in this table below:

It is IMPERATIVE that you consider these caps and seek professional help if you are unsure with any tax strategy. Any amounts contributed over and above these caps will only lead to the dreaded Excess Contributions Tax and would detriment all the tax benefits of a better tomorrow. It should also be mentioned that, your Concessional Contribution Capis also made up your Superannuation Guarantee Contribution (currently at 9.5%) and any further Before-Tax Contribution made to your Super Fund.

Please note this article is for information purposes only and does not constitute financial product or legal advice. The content has been prepared without taking account of the objectives, financial situation or needs of a particular individual and does not constitute financial product advice

Ivan Filipovic is authorised through Dover Financial Advisers Pty Ltd – Australian Financial Services Licensee -License No. 30748 – Dover Authroised Representative Number 1244358

Redwood Wealth Pty Ltd – Dover Corporate Authorised Representative Number 1244359

Ivan Filipovic is a leading SMSF Specialist Advisor with Redwood. Ivan has over 17 years provides a range of services across all sectors of Self-Managed Superannuation, Wealth, Property and Finance with an emphasis on long term wealth strategies. Ivan provides detailed strategies at https://redwoodadvisory.com.au/. Ivan is a Chartered Accountant, ASIC registered auditor, Mortgage Broker and Licensed Property Professional.