One of the key strategies of SMSF is to invest in direct property. While some SMSFs may have sufficient funds to purchase a property in cash, many others, particularly those with a younger demographic, have chosen to use a loan to purchase their property. There are two methods to secure a loan either through a third party lender or a related party loan.

During the last five years, SMSF lenders have charged a higher interest rate than standard investment loans. To take advantage of the improved rates, many borrowers have avoided the set up costs of a SMSF lender and borrowed off a related party. However its important to the multitude of guidelines to ensure your loan is compliant with superannuation law.

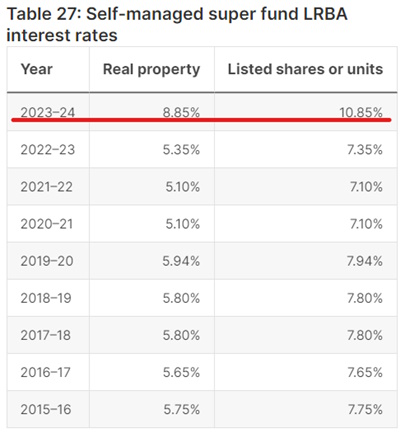

Consistent with one of these guidelines is the necessity to charge interest at an arm’s length rate. Starting from 01/07/2023 (2024 financial year), the ATO significantly increased the rate to 8.85% (from 5.35%), which is quite a significant jump from one year to the next, unlike the RBA interest rate decisions, which are more staggered.

Consequently, SMSFs with LRBAs need to ensure they are paying 8.85% interest. Another guideline from Practical Compliance Guideline 2016/5 is that SMSFs with related party LRBAs have a maximum term of 15 years.

This will be challenging for SMSFs that do not have a sufficient cash balance to make the increased repayments. Therefore, it is important to plan ahead to ensure repayments are made on a regular basis. On the other hand – SMSFs with excess cash will welcome the increase, which can be seen as a way to draw funds from super without being retired.

It is important to comply with safe harbour rules, as failure to comply may result in income generated being taxed as Non Arms Length Income (NALI).

The increased interest rate from 8.85%, along with the 15-year loan term, will, in many cases, necessitate that the SMSF pay higher loan amounts in 2024. Or at the very least, a review of the loan agreement to ensure it is consistent with an arm’s-length agreement.

Disclaimer – The content has been prepared by Redwood Advisory Pty Ltd without taking account of the objectives, financial situation or needs of a particular individual and does not constitute financial product advice. This article should not be considered personal financial advice as it is intended to provide factual information only.