When considering whether to take out life insurance, income protection or trauma insurance it is important to understand the differences between stepped or level premiums to determine which is the best option for you, both now and in the future. Put simply, insurance premiums generally increase the older you get, as the more likely you are to make a claim. For Insurance, you can choose between stepped and life premiums – so what are the differences? Stepped premiums are most commonly used, representing around 70% of all policies written.

Stepped Premiums

Stepped premiums generally are cheaper when you are younger and increase with age. The younger you are, the cheaper the premium – makes sense right?

| Advantages | Disadvantages |

|---|---|

| Lower initial premiums to assist affordability | Insurance can be more expensive at older age when insurance is needed most |

| More suited to short term insurance needs | Can be unaffordable when you get older |

Level Premiums

Level premiums generally don’t change year to year and average out over your lifetime. They are calculated on your age at the start of the policy and premiums remain consistent the older you get. Put simply, you will pay more at the start of taking out an insurance policy, however the premium costs will provide a greater long term saving over your lifetime as the insurance premiums average out over time.

| Advantages | Disadvantages |

|---|---|

| Fixed premiums over the life of the policy and generally break even after 10 years | Pay higher premiums at the start of the policy |

| Flexibility to increase your cover and premium if you choose and the significant cost savings that can be achieved over the long-term |

Case Study of Stepped vs Level Premiums

Age: 37

Occupation: A class – Sales Manager

Cover: $1,500,000 Life Cover (super)

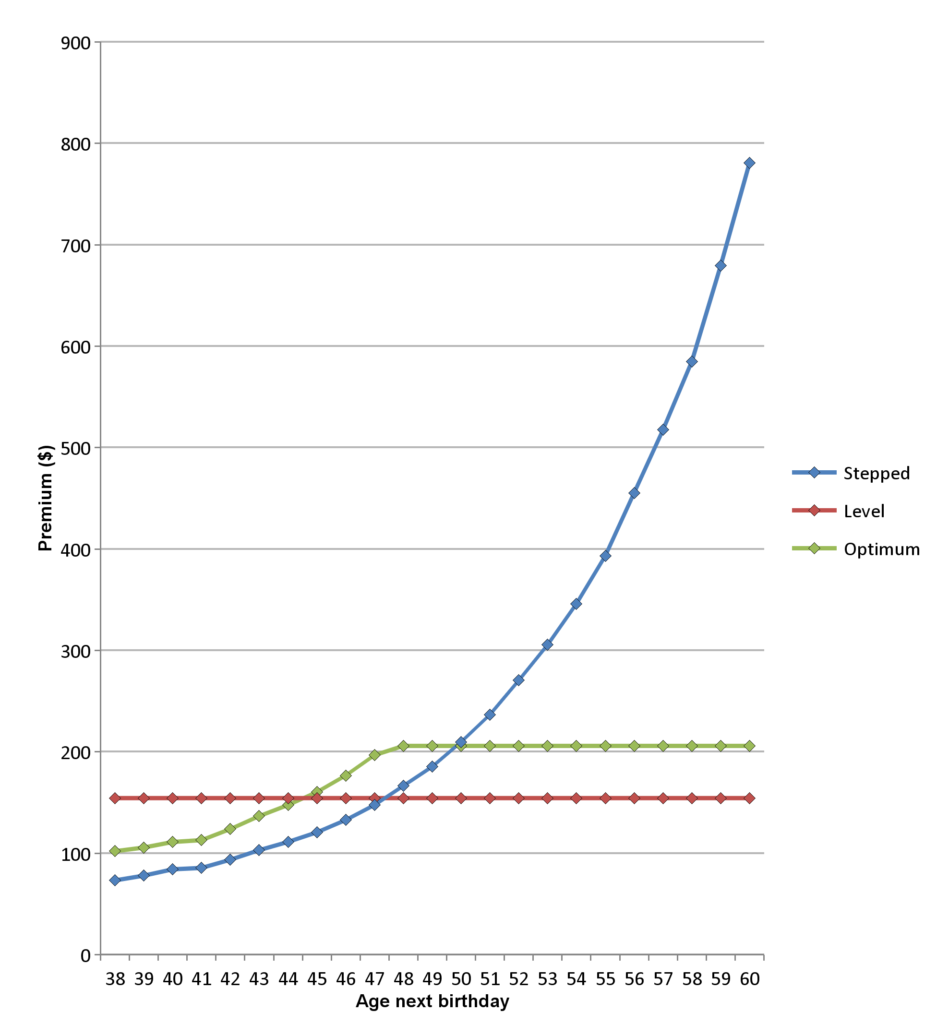

The graph below details the difference in Stepped vs Level premiums from age 37 through to 60 for the above individual. You will notice the Stepped premiums per year will be lower for the first 9 years until they reach break-even point with the Level premiums at around age 47. The stepped premiums will then continue to increase significantly over the remaining life of the policy. The advantage of the level premium is evident as the stepped premium increases above the age of 47. At the age of 54, the Cumulative Stepped Premium is $33,002 vs Cumulative Level Premium of $31,491.

Superannuation Life Cover Plan Stepped vs Premium

Further analysis of the comparisons between Stepped premiums vs Level premiums are explained in the below graph.

| Age Next B’Day | Monthly Stepped Premium | Cumulative Stepped Premium | Monthly Level Premium | Cumulative Level Premium |

|---|---|---|---|---|

| 38 | $73.21 | $878.52 | $154.37 | $1852.44 |

| 39 | $77.93 | $1813.68 | $154.37 | $3704.88 |

| 44 | $111.17 | $7,544.28 | $154.37 | $12,967.08 |

| 49 | $185.42 | $16,579.68 | $154.37 | $22,229.28 |

| 54 | $346.07 | $33,002.28 | $154.37 | $31,491.48 |

| 59 | $679.52 | $64,571.88 | $154.37 | $40,753.68 |

| 64 | $1409.87 | $129,578.28 | $154.37 | $50,015.88 |

As you can see from the above table, the savings in Level premiums over the long-term in this case start to benefit from 54 years of age after which Stepped premiums increase drastically with the age of the member.

Should I choose stepped or level premiums?

This depends on a short term vs a long term view. Initially when we see insurance premiums we can be mis-lead in thinking the cheaper Stepped premium option is the better option than level.

But when looking deeper Level premium cover provides a greater long term saving and in many cases can save you up to 50% of the total amount of insurance cover paid over your life time.

Claims history has proven to us that when we most need insurance (ages 40 to 55) the cost of insurance can sometimes be too expensive to keep. By taking Level cover your insurance premium will stay the same, so in our later years when we need the cover the most, we will still be able to afford it. Take a look at the case study below

Why choose stepped premiums?

Since stepped premiums are much more economical than level premiums at the beginning of a policy, they are good if you’re looking at keeping a short-term policy just to pay off your loans or debts.

Similarly, if you’re a young family struggling to make ends meet (kids do, after all, gobble up a lot of your income and savings!), a stepped premium helps ease yourself into a Life Insurance policy. After all, it’s better to choose a cheaper premium than to forego Life Insurance altogether because of unaffordability. Once your finances are freer, you can increase your cover as you wish.

Why choose level premiums?

Level premiums are ideal if you plan to keep your Life Insurance policy long-term. If you’ve just taken out a mortgage and plan to repay it over a few decades, you may want to ensure you’re covered by Life Insurance for the same length of time.

Level premiums also suit you if you’re young and look at getting a head start on a long-term policy. While you may pay more initially, you could end up saving a substantial amount over time.

How do I know which premium is right for me?

Getting the right premium from the beginning ensures that you’re getting the best Insurance policy for your circumstances.

It’s easy to assume that stepped premiums are better for you since they’re cheaper. But while your budget is an important consideration, it’s also a good idea to think about your future plans for your policy. Do you intend to have it for decades? If that’s the case you may save more with a level premium.

In the end, it comes down to assessing the early affordability of stepped premiums against the long-term affordability for level premiums. Its best to obtain Financial Advice to assist you in determine the right insurance for you.

Disclaimer –

Please note this article is for information purposes only and does not constitute financial product or legal advice. The content has been prepared without taking account of the objectives, financial situation or needs of a particular individual and does not constitute financial product advice

Ivan Filipovic is authorised through Dover Financial Advisers Pty Ltd – Australian Financial Services Licensee -License No. 30748 – Dover Authorised Representative Number 1244358

Redwood Wealth Pty Ltd – Dover Corporate Authorised Representative Number 1244359

Leave a Reply